Url: Apply now for the Capital Just one Venture X Benefits Credit score Card (this is the greatest publicly out there provide for the card, and we enjoy your guidance if you use our website link)

We just lately observed the start of the new Capital A single Enterprise X Rewards Credit score Card, which is Funds One’s new high quality credit rating card.

Whilst the card has a $395 yearly rate, there are so numerous factors to get this card, from the welcome bonus of 100K miles, to ongoing perks like a $300 annual vacation credit score, 10K anniversary bonus miles, a Priority Go membership, accessibility to Funds Just one Lounges, Hertz President’s Circle elite standing, and wonderful licensed person benefits. I applied for this card and was right away accredited, and I know many OMAAT readers are in the identical boat.

In this post I desired to concentrate on the one reward that should most aid offset the annual price of the Capital 1 Undertaking X, which is the card’s $300 yearly travel credit rating. Let’s get into all the details of how this functions.

How does the Venture X $300 once-a-year travel credit history perform?

The Cash A person Enterprise X delivers a $300 annual travel credit score, which can be redeemed by Money Just one Journey. Here’s what you need to have to know about that:

- The credit applies every single cardmember 12 months (or anniversary calendar year, if you prefer), together with the calendar year in which you open the card the credit rating timing is not centered on the calendar calendar year

- The credit can be used across one or multiple transactions, until the $300 restrict is attained

- There’s no registration required to use the $300 yearly vacation credit score

- Any acquire by way of Capital One particular Travel qualifies to utilizing this credit, so there is all sorts of travel you can organize this way

- The credit rating will generally seem in your account in one to 7 business enterprise times of creating an suitable purchase

- If the credited Cash A single Journey buy is canceled, the assertion credit rating may perhaps be taken out from your account, however can be reissued on any past or potential Cash One particular Vacation order of up to $300

What vacation can you e-book by means of Cash 1 Vacation?

Money 1 Vacation is Funds One’s journey portal, as you may have guessed primarily based on the title. The portal is run by Hopper, and Cash A single is effectively acting as the travel agent listed here. You can use Money A single Travel to e book all the things from flights, to hotels, to automobile rentals.

In basic I’m not a big fan of employing vacation portals, even though in my opinion Money One particular Vacation is the most effective travel portal of any of the big credit card organizations. You can easily lookup flights, inns, and auto rentals.

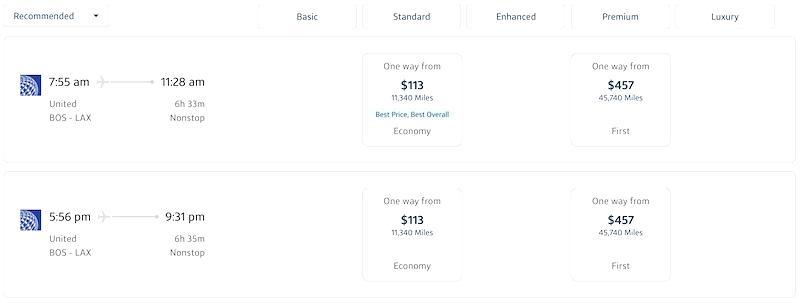

The portal has some nifty functions. For illustration, when exploring flights, there is a calendar exhibiting the dates with the finest costs, which is something I wish we’d additional continuously see from airlines.

Likewise, the alternative to filter benefits is great, better than with any other portal out there, in my opinion.

If you required to utilize your $300 once-a-year travel credit score in the direction of a obtain (like a flight), you’d just want to make the acquire with your card, and then the assertion credit score will article mechanically.

Maintain in intellect that the Enterprise X is also rewarding for buys by Funds A single Travel, so you can earn a lot of miles for any shelling out on leading of the credit score volume. The card delivers:

- 10x Venture miles on accommodations and rental autos booked by using Funds Just one Vacation

- 5x Enterprise miles on flights booked by means of Funds 1 Travel

But is not reserving by credit card vacation portals frustrating?

Some people are in all probability considering “I never genuinely want to reserve by a travel portal however.” I listen to you. To be honest, I only rarely use journey portals. Even if a journey portal is fantastic, there are downsides to applying them:

- On the flight front, in the celebration of program adjustments or seeking to cancel, it can be easier to do so if you e book direct, in particular in an period wherever airlines mainly allow for absolutely free ticket modifications

- On the resort entrance, you do not usually get elite benefits or generate details when reserving by way of a 3rd party

- On the vehicle rental entrance, there are normally price cut codes out there online that just can’t be made use of if reserving by means of a portal

That being explained, I still price this credit score at very near to face benefit, and will have no concerns in any way working with it. What’s my approach? To preserve items very simple, I’ll almost certainly reserve a solitary flight that charges $300+ by in this article at least when per year, and that will be reimbursed.

You continue to frequently get paid details and acquire elite perks when booking flights by means of a portal, and the pricing is pretty much often similar. So the possibility price to scheduling this way is restricted.

The way I see it, obtaining to e book as a result of Money A person Vacation is hardly a big offer or anything that helps prevent this from getting maximized, and I’ll have no troubles maximizing this. Even as anyone who is generally opposed to making use of portals, I really do not look at this as currently being a major deal.

How does this examine to vacation credits on other playing cards?

How does the Funds A single Enterprise X $300 once-a-year vacation credit look at to the credits issued by other high quality playing cards? Just to assess:

I’d argue that the Cash A person travel credit score isn’t as straightforward to use as the Chase vacation credit, but is a lot simpler to use than the American Convey travel credit rating.

Now, that does not notify the whole tale of the cards’ benefit propositions, although:

- The Venture X has by considerably the least expensive annual cost of the 3 playing cards

- The $300 yearly journey credit is only a single of the once-a-year perks the card offers — the card also gives 10,000 anniversary bonus miles, which can be redeemed for $100 value of journey, or can be transfered to airline & lodge partners at a ratio of up to 1:1

- For savvy vacationers, the $300 vacation credit rating additionally 10,000 reward miles must be worthy of more than the card’s $395 once-a-year rate, not even factoring in something else

Base line

The new Funds A single Enterprise X is very lucrative. The card has a $395 yearly cost, and 1 of the key things that offsets that payment is the $300 once-a-year vacation credit, which can be utilized toward nearly any buy with Money One Journey.

Whilst there may possibly be a slight headache aspect to some in making use of a portal, this genuinely shouldn’t be that hard to improve on a flight, hotel, or automobile rental. Personally I approach on just reserving a $300+ flight each year by way of the portal, and that’ll get me the $300 assertion credit history.

To fellow Undertaking X cardmembers, what is your system for using the $300 once-a-year journey credit rating?