Pyrosky/E+ via Getty Photos

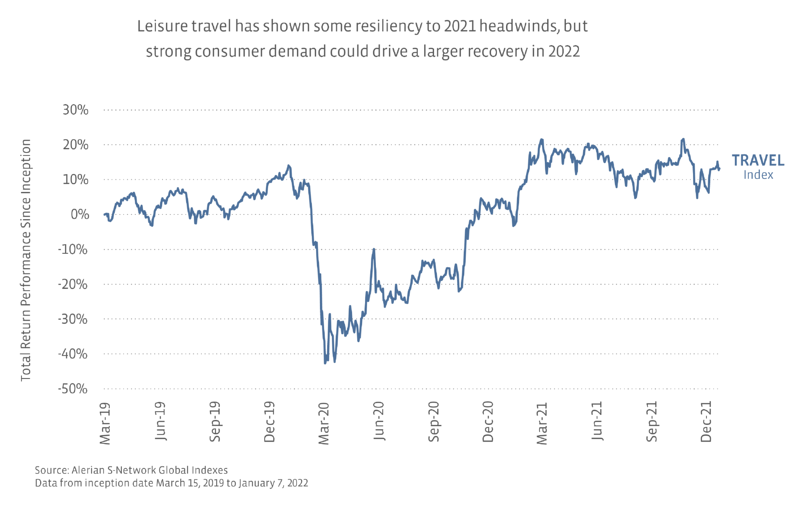

Following a occupied air journey season this Thanksgiving, the Christmas journey time was predicted to exhibit identical strength. But news headlines have been dominated by a file quantity of COVID-19 staffing-related flight cancellations starting all around Xmas Eve. While ensuing in some original issue for the sector, fundamental passenger flight info indicates that bookings and shopper desire are nevertheless sturdy, and most of the present-day capability concerns appear somewhat shorter-time period in comparison to 2020 and early 2021 disruptions. The leisure journey sector, as measured by the S-Community Global Journey Index (Journey) showed resiliency to these late 2021 headwinds and stayed effectively flat throughout the earlier month. Very first of all, airline shares held up relatively effectively through the disruptions – probably offsetting brief-time period uncertainty with the long-phrase desire outlook. Additionally, the Journey index signifies the broader leisure travel sector with a 25{e9f0aada585b9d73d0d08d3c277fd760092386ec23cac37d50f4b8cd792b062a} weighting (as of January 7, 2022) to ancillary beneficiaries like buyer goods and companies businesses, which may well be less sensitive to journey disruptions and can benefit more from consumer sentiment and retail shelling out.

Leisure Vacation Sector, As Calculated By The S-Community World-wide Vacation Index (Vacation) Alerian S-Network Global Indexes

Purchaser leisure demand from customers persists, when latest potential difficulties feel to be non permanent

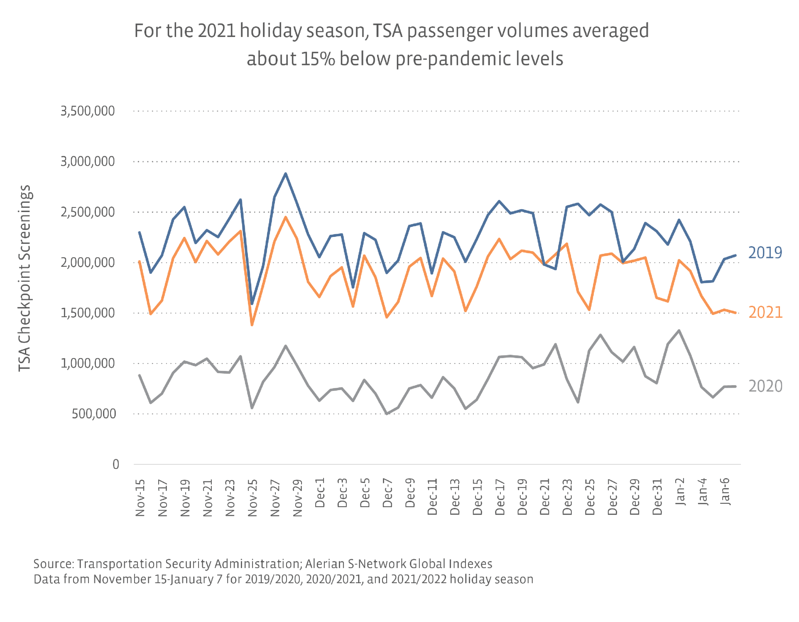

The chart down below exhibits TSA checkpoint figures around the Thanksgiving and Xmas holidays, which provide as a proxy for passenger volumes and can offer a go through-as a result of for leisure travel demand from customers. Flight bookings are usually the best during the winter season vacations – as opposed to resort bookings, which are commonly reduce, because individuals tend to commit time viewing household. On average, there had been only about 15{e9f0aada585b9d73d0d08d3c277fd760092386ec23cac37d50f4b8cd792b062a} significantly less travellers in the 2021 holiday time compared to the 2019 vacation season, which implies that most travelers are resuming their standard holiday schedules. The widening gap toward the conclude of December can be attributed to the history quantity of flight cancellations starting off in late December – generally due to staffing shortages from COVID-19 infections. In accordance to info from FlightAware, in excess of 24,000 U.S. flights were cancelled in involving Xmas Eve and January 7, which amounted to as considerably as 7{e9f0aada585b9d73d0d08d3c277fd760092386ec23cac37d50f4b8cd792b062a} of planned potential.1

TSA Holiday Year Passenger Volumes Transportation Protection Administration Alerian S-Community World-wide Indexes

What’s diverse this time?

Although COVID-19 related flight cancellations and staffing shortages may feel like a repeat of the early pandemic days, the setting should be pretty unique in 2022. Unlike 2020, numerous individuals are vaccinated and prepared to resume vacation immediately after keeping off getaway programs for pretty much two several years. Long-phrase desire fundamentals are more supported by a massive yearly raise in 2021 aircraft orders noted by airline brands this week.2 This indicates that airways are setting up to see a restoration in demand from customers, in addition to being in a far better place to invest cash. On the supply side, when December’s COVID-similar staffing shortages may perhaps be harmful to functions in the subsequent quarter, these are much easier to prevail over relative to components like world vacation rules. Countries seem to be less reactionary and restrictive now than they had been for the duration of the first outbreak in 2020 given more popular vaccine distribution.

Base Line

While the leisure travel sector held up comparatively very well irrespective of headwinds in 2021, gains were muted relative to anticipations that the COVID-19 vaccine would revive the journey field. 2022, however, is a pretty distinctive atmosphere relative to both equally 2020 and 2021. On prime of larger vaccination fees and much more lenient travel constraints, years of pent-up consumer demand and widespread inflation could lead to both of those greater volumes and prices inside the vacation sector, which could help a additional constructive outlook for 2022. These could be reflected 1st inside of airline bookings and client discretionary paying, but should sooner or later extend into other leisure sectors like lodges, rental auto agencies, and cruise strains.

The S-Community International Journey Index (Vacation) is the fundamental index for the ALPS Global Journey Beneficiaries ETF (JRNY).

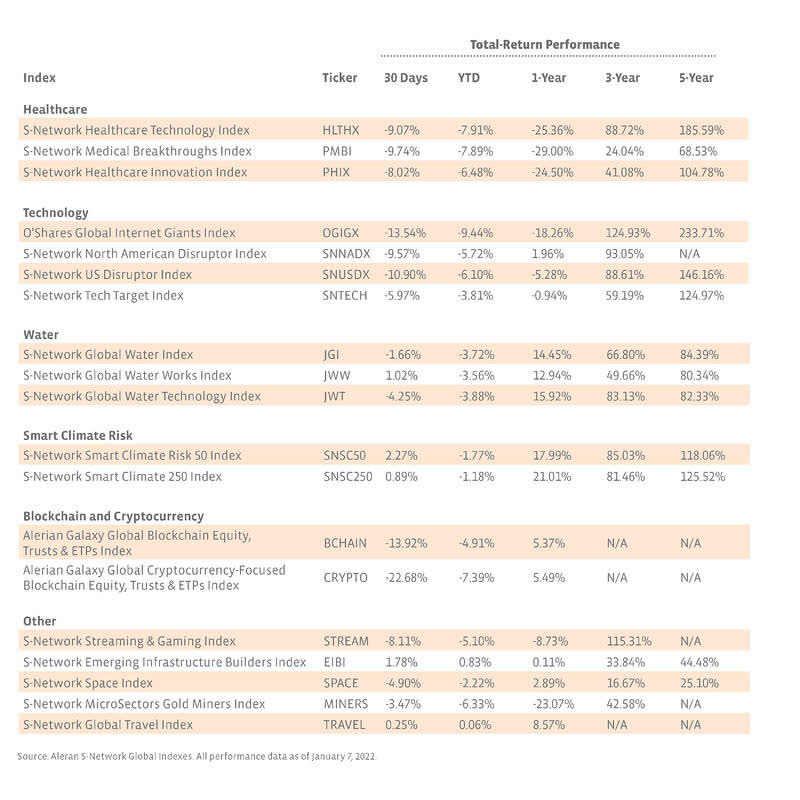

Alerian S-Network Indexes Total Return Efficiency Alerian S-Network World wide Indexes

Footnotes:

2 CNBC

Disclosure: © Alerian 2021. All rights reserved. This content is reproduced with the prior consent of Alerian. It is furnished as normal information only and need to not be taken as financial investment advice. Employees of Alerian are prohibited from possessing unique MLPs. For far more information on Alerian and to see our comprehensive disclaimer, stop by Disclaimers | Alerian